newspaper

print coverages

Tier 4 Institutions to Adopt International Credit Ratings for Global Funding Access

BY F MALE: The Uganda Microfinance Regulatory Authority (UMRA) has rallied Tier 4 financial institutions to adopt international credit rating standards to secure global funding.

Uganda’s microfinance regulator encourages lenders to embrace credit ratings

UMRA is optimistic that the introduction of the international credit rating system will strengthen Tier 4 financial institutions and help them attract cheaper credit facilities globally.

Ugandan SACCOs, Microfinance Institutions urged to embrace global credit rating systems

Speaking during a two-day conference for Tier 4 financial institutions organised by the Uganda Microfinance Regulatory Authority (UMRA) in Kampala on Wednesday, Mr. Moses Ogwapus, the Commissioner of Financial services at the Finance Ministry

UMRA to monitor and rate SACCOs to combat loan sharks

The Uganda Microfinance Regulatory Authority (UMRA) has announced that it will begin monitoring Savings and Credit Cooperatives (SACCOs) to rate both borrowers and lenders,

Private Sector Foundation Uganda

PSFU, @UgMicrofinAuth, ICRA, convened a gathering of 500 Ugandan MFIs to discuss credit rating as a method of evaluating the credibility of these MFIs, with the ultimate goal of enhancing their prospects for obtaining affordable and enduring capital from international investors.

ESG Rating and its role in Uganda’s financial ecosystem

In today’s rapidly changing business landscape by embracing ESG principles, banks can mitigate risks associated with environmental, social, and governance issues that seize

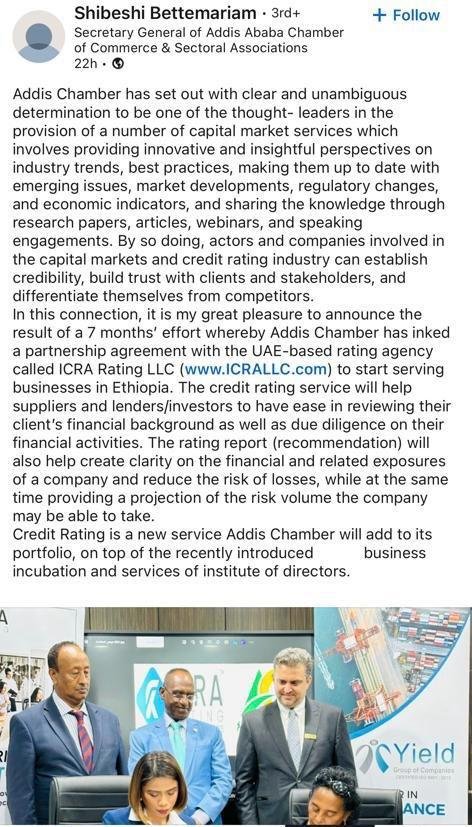

Dubai-based ICRA bolsters Tanzania ties with MoU

THE Dubai-based International Credit Rating Agency (ICRA) has made strategic moves to solidify its footprint in Tanzania, showcasing its commitment to growth and collaboration by signing Memorandums of Understanding (MOUs) with four prominent financial institutions in the country.

Understanding Credit Rating Services within Uganda’s Financial Ecosystem

A Memorandum of Understanding (MoU) with PSFU, We are delighted to announce the signing of a Memorandum of Understanding (MoU) with the Private Sector Foundation Uganda (PSFU).

Credit ratings' role in MFIs, marginalized communities

Why own credit rating agency matters for Tanzania

ICRA Rating Agency Limited is Tanzania’s first credit rating agency, opening up a new chapter for the country’s financial markets.

ICRA yatoa neno kwa MFIs

DAR ES SALAAM; WAKALA wa Ukadiriaji (ICRA), imesema ukadiriaji wa mikopo ni muhimu kwa taasisi ndogo za fedha (MFIs) zinazolenga kusaidia jumuiya zilizotengwa na biashara ndogo.

ICRA yajivunia kutambulika na BoT

“Utambuzi huu wa kifahari unaiweka ICRA kama wakala pekee wa kikanda wa ukadiriaji wa mikopo ulioidhinishwa na benki kuu inayotoa huduma zake. Zaidi ya hayo, ICRA imefikia hadhi tukufu ya Taasisi ya Nje ya Tathmini ya Mikopo (ECAI),” imeeleza taarifa hiyo.

Sovereign rating to improve business climate, entice local and foreign investors

IN the realm of credit risk assessment, the ICRA Credit Risk team stands as a model of diligence and equal treatment, employing a meticulous methodology to evaluate the creditworthiness of entities.

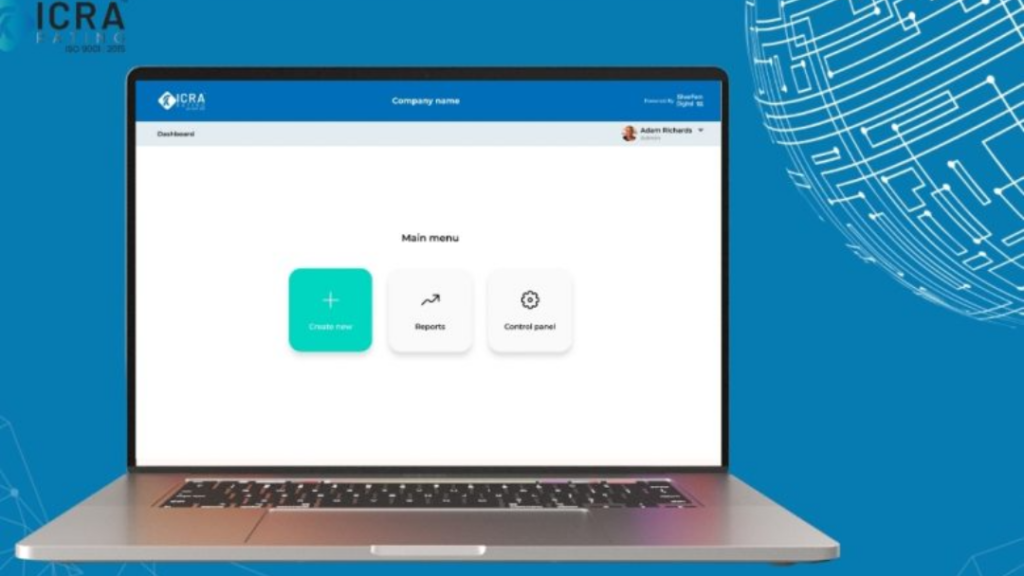

Transformation in Credit Assessment Worldwide as ICRA scorecard is launched

The ICRA Scorecard represents more than just a tool; it embodies a paradigm shift in credit assessment methodology. By embracing innovation and inclusivity, ICRA Rating aims to foster financial inclusion on a global scale, promoting fairness and equality in the financial sector.

Embracing ESG principles key to responsible business

IN today’s corporate landscape, Environmental, Social, and Governance (ESG) is gaining prominence as pillars shaping the way businesses operate, prioritize and are evaluated globally.

Credit Rating Crucial For Zambia - Financial Expert

A FINANCIAL expert says credit rating agencies play a crucial role in shaping the country’s economy, attracting investors, and ensuring transparency in financial markets.

Zambia’s credit rating upgrade needs all players

INTERNATIONAL Credit Rating Agency (ICRA) country director David Mwambazi says both the Government and the private sector must play a role in improving the country’s credit rating.

Zimbabwe’s Economy Surges with Reforms and Resilience, Says Credit Rating Agency

HARARE – Zimbabwe’s economy is undergoing a significant transformation, demonstrating impressive resilience and growth thanks to a series of strategic government initiatives.

Dubai rating agency gives thumbs up to Zim economy outlook

Zimbabwe has growth opportunities for investors and entrepreneurs, a UAE-based credit rating agency has said. ICRA Rating released a statement that said while Zimbabwe has negative

Events

Improving lending in the tier 4 sector - UMRA aiming at credit rating of microfinance institutions

UMRA to monitor and rate SACCOs to combat loan sharks

AGAFA MU BY'OBUSUUBUZI

Social Media

MEDIA